5 Rules to Protect You From Financial Predators

I don’t blame you.

You had jargon grenades lobbed at you.

Your fears and anxieties were teased out of you and handed to you like a cloud of toxic cotton candy.

Then, after you signed on the dotted line, you discovered that the thing you bought was not what you were sold.

You thought you were buying safety.

If You Want Your Portfolio to Grow Heroically, Leave It the F*ck Alone

Meditation can be torture.

There you are, sitting cross-legged on the black zafu (hard round pillow) piled on top of the black zabuton (big square flat pillow) at the Zendo with a bunch of other silent people trying not to move, and your nose starts to itch.

You try hard not to scratch.

Have No Shame About Your Money Procrastination. Try This Instead.

I drive an hour and a half round trip to get art framed.

My framer is not the cheapest nor the fastest. But she has a good eye, I trust her judgment, and she’s patient, as invested as I am in making sure the art is displayed to its best advantage. She takes pride in her work, not trying to nickel and dime me but problem-solving the most cost-effective way to get the desired effect.

She gives a shit, and her workmanship shows it.

The Dirty Little Secret Investment Professionals Know That You Don’t

It’s all made up.

That research report your broker just emailed you about the next Amazon?

Pure fiction.

Those elaborate financial models forecasting earnings out 5 to 10 years?

Balderdash.

The case for the next ten-bagger being cheap?

Malarkey.

How to Change 3 Common Sabotaging Beliefs About Money into Ones That Can Help You Achieve Financial Security

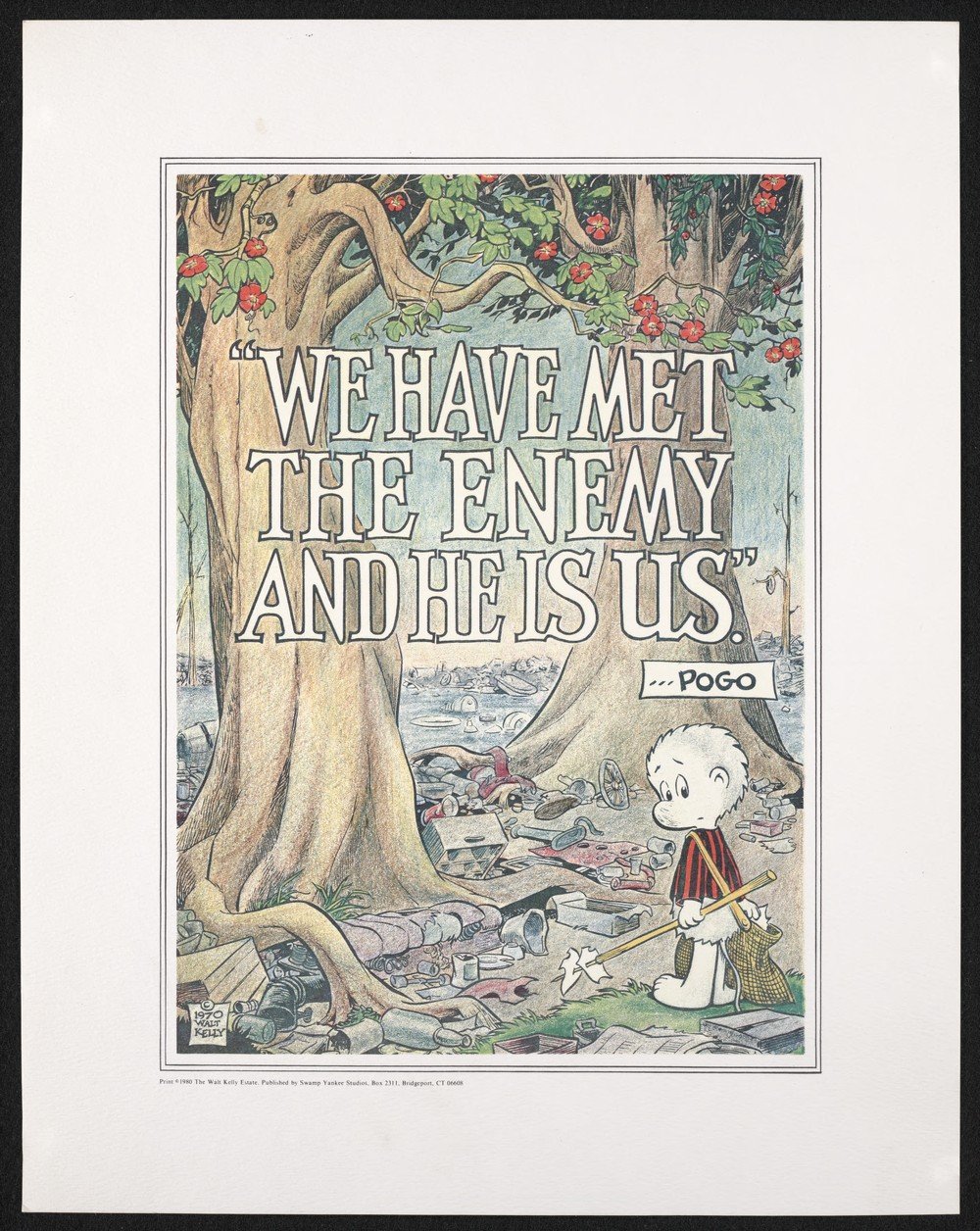

“We have met the enemy and he is us.”

Walt Kelly’s famous Pogo cartoon from 1970 came to mind as I was teaching a class for the YWCA of O’ahu’s Enterprising Women of Color program. We were discussing money beliefs and how they can undermine our success.

Here are 3 commonly held and sabotaging beliefs that surfaced, plus my color commentary and tips for shifting them into a more productive mindset.

Navigating Gender, Money, and Power

“How does your husband feel about you making more money than he does?”

I was genuinely puzzled by this question.

The person asking was my male business partner. We’d finally gotten our firm off the ground and were now starting to earn. “He doesn’t mind,” I said. The truth was I didn’t know. We never talked about it.

3 Things to Help You Steward Your Wealth Better, Faster, and with Grace

Stewarding your financial future when confused, avoidant, or anxious is hard. Even if you know WHAT to do, you may struggle to DO it.

This is normal, because our survival and our self-concept are at stake.

But stewarding your inner and outer riches well, from a grounded and calm place, is 100% doable, and I’m here to show you how.

Accept These 3 Truths About Your Net Worth to Better Steward Your Resources

You have a number that’s yours alone.

Unlike your social security number (or non-U.S. equivalent), this number, also unique to you, is emotionally loaded. You may avoid, resent, be pissed at, obsess over, tolerate, be resigned to, or be ashamed of it, but will rarely celebrate it.

It’s your net worth.

3 Mistakes to Avoid When You’re Swamped with Good Fortune

Just ask Silicon Valley Bank (SVB).

Not gonna school you on FDIC insurance, why big-shot Silicon Valley Venture Capitalists act like lemmings, or god forbid, the disastrous consequences of an asset/liability mismatch.

Nope. I’m gonna talk about how not to get mugged by good fortune.

How To Ditch the Behavior That’s Breaking Your Financial Plumbing

When you own a house built in 1961, you learn a lot.

Pastel tiles in the bathrooms are quaint. Record players and speakers embedded in the wall paneling are cool. Ditto for hidden wet bars with booze bottle wallpaper.

Vintage plumbing fixtures, not so hip.

Let Your Spending Mistakes Make You Richer

I dreaded going through last year’s expenses.

I didn’t want to add up late-night doom-scrolling impulse purchases, money spent on self-improvement trying to fill a sinkhole of inadequacy, and the contact lenses I couldn’t get my shit together to send in the $250 rebate for by December 31.

It’s embarrassing.

5 Rules of Thumb to Become a Savvy Borrower

Devil spawn or road to easy riches?

Debt is one of the most controversial tools in finance. It’s been demonized and lionized, depending on who’s talking. Both lender and borrower take on risk, and both can lose their shirts in the process. An economic nuclear winter will kill both sides, but in general, the more leverage, the greater the risk.

“The harder they come, the harder they fall,” to quote Jimmy Cliff.

How to Make a Good Money Decision When Your Heart Says Yes and Your Wallet Says No.

My coaching client (also a coach) was grappling with a money dilemma.

She wanted to enroll in a $5,000 certification program offered by a coach she loved. But she’d already invested more than $25,000 in coaching training, and while her practice was growing, it was only just starting to make money. She’d sworn not to spend more of her family’s nest egg until her business was more profitable.

She was torn between desire and reality.

Does Your Spending Suffer From a Madonna/Whore Complex?

Are the things you want to spend on “dirty”?

Do you treat money differently depending on its source?

If so, you may have a madonna/whore complex about the objects of your desire. In psychology, this syndrome is defined by Freud (via Wikipedia) as "Where such men love they have no desire and where they desire they cannot love." Translation: “Good girls” are lovable, but not sexy. “Sexy girls” are not marriage material.

A Covid Reading Recommendation

Think relationships, not transactions, for better business.

It’s time to put humanity back into capitalism. To create community. To delight. To inspire.

I believe that business can be a profound generative act of creativity and generosity. It does not have to be exploitative or extractive.

Why Warring Money Mental Models Will Hurt Your Business

We’re not taught that business is like physics, but it is.

Just as the laws of thermodynamics, motion, mass and energy help us understand how the world works, the laws of finance help us anticipate the results our business decisions will create.

Not that these laws can’t (or shouldn’t) be broken. The laws of finance can be defied in a way that the laws of gravity can’t.

Business has an internal logic.

How To “Do Well” While “Doing Good” in Business

I have been back home in Hawai’i since New Year’s Eve.

My mom turns 90 this month, and she has two older siblings still living; my aunt Hatsuko (99 years old!) and my uncle Masa who’s 92. It’s been a blessing to spend time with them and my extended family and to reconnect with friends and classmates (Punahou ‘79).

I’ve also been mixing business with pleasure.

Business and Money Trauma Is Real. Don’t Let It Consume You.

I grew up in Wahiawa, a dusty, sun-baked old plantation town in the middle of Oʻahu. It felt like the epicenter of the American war machine, as it was surrounded by an air force base (Wheeler), an army base (Schofield), and a naval communications center. I lived up in the heights, and my elementary school abutted army training grounds.

The soundtrack of my childhood was more Apocalypse Now than Mr. Rogers.

Shop Local and Save Money. Yes, SAVE Money and Do Good.

On New Year’s Eve I came back home to Hawai’i, in time for the greatest amateur fireworks extravaganza on the planet.

After a few days, I’m suffering from culture shock. Everything is both weirdly familiar and slightly off. I feel like I’ve been teleported to an alternate universe and I’m not quite sure who I am anymore.

But I’ve been the outsider my whole life, which makes me observant.

Week 4 of Round-up of Feng Shui Your Financial House

I have always preferred sunrises to sunsets, the start of journeys to the end, and the prologue of a book to its epilogue.

I am in love with potential, with what lurks over the horizon, with opportunity yet to be spent, with fresh starts and swelling tree buds.

I love the New Year.

For more thoughts and ideas on financial intimacy, subscribe to my weekly newsletter Cultivating Your Riches.