3 Things to Help You Steward Your Wealth Better, Faster, and with Grace

A present for you 🎁

Your gift of time and attention is precious, and I’d like to say thank you by offering you a free second opinion on your investment portfolio.

Just hit reply, and I’ll send you instructions to upload securely. There’s no need to tell me the dollar value and I’ll keep your info confidential.

In return, you’ll receive my hot take by email.

Don’t be shy. This offer is a no-brainer!

Where else will you get someone who managed billions to look at your portfolio?

••• A QUICK NOTE •••

Dear friend,

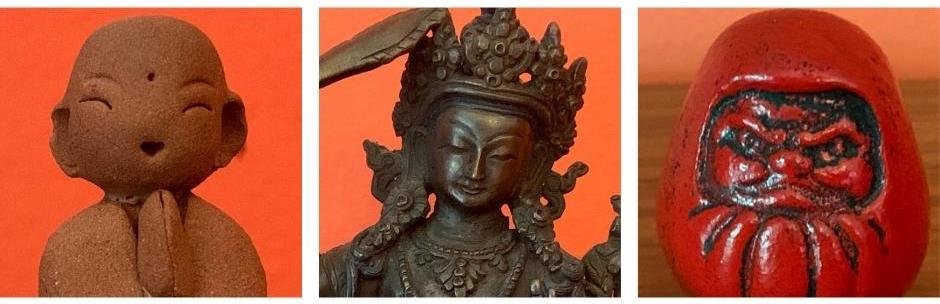

This week I’m introducing a new format to help you with your financial well-being. I’ll be sharing weekly tips on Safety, Clarity, and Action, using the Three Bodhisattvas of Finance (Jizo, Manjusri, Daruma) as inspiration.

I’ve been thinking a lot about money and power lately and would welcome your stories and questions on that topic.

Starting next week, I’ll be back with both essay + resources.

Enjoy!

Stewarding your financial future when confused, avoidant, or anxious is hard. Even if you know WHAT to do, you may struggle to DO it.

This is normal, because our survival and our self-concept are at stake.

But stewarding your inner and outer riches well, from a grounded and calm place, is 100% doable, and I’m here to show you how.

The Three Bodhisattvas of Finance

Here’s the helpful framework that launched this newsletter.

The TLDR?

Feeling Safe allows you to get Clarity on what you want and your circumstances, leading you to take clear-eyed Action grounded in reality.

Jizo: Your nervous system goes on red alert when you don’t feel safe

Your focus narrows, you freeze, avoid, rush, and your money suffers.

Here’s an antidote:

Knowing your psychology helps you be more self-accepting; with self-acceptance comes peace. When you realize your reactions and behaviors are common, you can let your guard down and cut yourself some slack. You make better decisions from that place.

The Psychology of Money by Morgan Housel is my top pick on this subject, and you’re in luck!

Here’s a quick and dirty way to instantly give your nervous system a dose of safety. Read Jason Shen’s superb newsletter highlighting Housel’s key concepts.

You’ll get 90% of the medicine in a fraction of the time.

Manjusri: Lift the fog of confusion and indecision with a stroke of clarity.

A little knowledge builds confidence in your ability to secure your financial future. Not knowing can be costly, and learning doesn’t have to be painful.

The world changes constantly, but we’re not always aware of WHY.

However, we know that the world changes faster than human nature does. Understanding the interaction between human behavior and markets will help you become a better investor.

That’s why I am a big fan of reading biographies and financial history.

Legendary investor Howard Marks has written a great recap of the markets over the last four decades. It’s lucid, well-written, and spells out the why, not just the what.

Even if you know nothing about investing, you will enjoy reading it. Better yet, you’ll make more informed decisions after reading it.

Daruma: Take Action aligned with your desires, values, and goals.

Inflation is moderating a tiny bit but will likely persist for a while (read Marks’ memo to learn why). It can be hard for your investments to keep up. Here’s a conservative way to protect yourself.

If you’re American and have $10,000 you don’t need for a few years, consider investing in I Bonds, an inflation-protected U.S. savings bond.

Here’s more info on what they are and how to buy them.

As always, if you need help with safety, clarity, or action when cultivating your riches, hit me up. There are lots of ways I can help, from acting as a sounding board to being your wing woman in a financial shitstorm.

For more thoughts and ideas on financial intimacy, subscribe to my weekly newsletter Cultivating Your Riches.