How to Remember Your Money

Killing a business is a lot harder than offing an inconvenient human, it seems.

The official death certificate for Daruma, my institutional money management firm took ~18 months after we shut our doors and gave back the last client dollar to arrive. Pandemic delays, bureaucratic snafus, and turf wars between Delaware and New York made for a slow and excruciating demise.

I’m a great loop opener and a terrible loop closer, so this limbo was agony.

I wanted to get on with the next chapter. The fun in life lies in the anticipation of what’s to come. Setting up for a party is happy work. The clean up afterwards? Drudgery. Scouring red wine from the white rug or fishing brie out from under the couch pillow is torture compared to hanging up party lights and pink balloons. We’d always rather plan for the next party than tidy up the last.

This holds true for money hangovers as well.

Dealing with Daruma’s demise was bad enough. Closing our 401K retirement plan was worse.

By way of backstory – retirement plans are highly regulated so employers can’t play footsie with their employees’ money. Employees that leave a company can continue to keep their 401K money with their former employer, forever. Companies hate these “forgotten accounts” because they are expensive to maintain and contain potential liability. Because Daruma was closing down for good we terminated our retirement plan.

Never Forget by Take That

If you need a ’90s boy band soundtrack for your quest to reclaim your funds and a reminder to “never forget,” here you go.

A new home had to be found for every 401K balance.

This meant that all current and former employees needed to make a choice – roll the money into an IRA (Individual Retirement Account) or the 401K of their current employer, or take cash and pay taxes and a penalty. They no longer had the option of walking away and leaving it behind.

We gave everyone oodles of time to decide, and waited. And waited. We cajoled, we pleaded, we begged. Crickets. 🦗🦗

I now totally understand why there are an estimated 24.3 million “forgotten” 401K accounts worth $1.35 Trillion floating out there with an estimated 2.8 million accounts added each year.

Herding cats is a 1000% easier than getting you to deal with your money.

I get it. I hate life admin too.

When you’re switching jobs, your priority (surprise!) is not rolling over your 401K balance into an IRA. Given the three options above or just leaving your money with your former employer, you’ll take the path of least resistance. You know the money is safe and yours forever, so there’s no hurry to make a decision or fill out paperwork.

You promise yourself you’ll deal with it later.

But we all know what ‘deal with it later’ means, especially, especially when it comes to our money. It means “Never”.

But given that Americans on average change jobs twelve times in their lives, all that job hopping creates a trail of “forgotten” 401K accounts. Think of it as a trail of sad broken money hearts, if that’ll help spur you into action.

I’m not unsympathetic. I, too, am guilty of paralysis caused by having too many choices and no love of paperwork.

Inaction is a form of action, however.

Being ghosted when all you’re trying to do is give people their money back sucks. We gave employees one last chance to do a rollover before cutting them a check and triggering tax consequences.

At this point, the last stragglers caved and sent in their forms. 🤷🏻♀️

I don’t want to make you feel guilty about abandoning your dollars. I want to encourage you to take action.

Here’s why you shouldn’t abandon your dollars to the indifferent guardianship of your former employer.

For one, they drove the retirement plan bus.

Your employer hired the plan administrator, gave you a pre-selected menu of investment options, and subjected you to whatever fees they agreed to. If you had an enlightened, sophisticated, or deep-pocketed employer, you probably had terrific, well-run low-cost options and lots of hand-holding to help you choose your investments.

But if that’s not your former employer, you may be paying too much in fees, have subpar funds, or a poor asset allocation. Even a “set it and forget it” portfolio needs periodic rebalancing.

But it’s not just the actual financial cost to you that grinds my gears.

It’s that your money could be IN YOUR CONTROL, BECAUSE YOU’RE NOW FREE TO INVEST IT any way you want.

There is no more powerful medicine than paying attention to what we love.

This money is the fruit of your labor. It’s your energy transformed into a currency that can make your desires tangible. AND YOU’RE LETTING YOUR MONEY BE CARED FOR BY INDIFFERENT STEWARDS who would rather you take it off their hands.

Yes, this is one small way you can stick it to the man.

But wouldn’t it be ever so much better for you to tend to your wealth lovingly?

Learn what you need to learn?

Pay attention in the right time intervals?

Integrate the cultivation of your wealth into your routine?

Invest your values and invest to reach your dreams?

OK, rant over.

I’m nagging because I believe in you and want you to have the most loving and intimate relationship with your money.

Here are two other places to look for “forgotten” money:

1. Empty out your coin jar and put all that loose change to work.

If you can’t be bothered to count and wrap your coins before depositing in your bank, use a Coinstar machine. It’s free if you choose a gift card option. Otherwise you’ll pay a ridiculous (11%+) fee. Money you put to work buying something you need, saving, or investing honors the energy you’ve put into creating it. Money, like Qi, wants to flow.

But Please don’t do what I did and wrap up your coins, then stick them in a drawer and forget about them. I literally discovered this pile today. 🤦🏻♀️ Depositing them tomorrow! 🙌

2. Check to see if you have any unclaimed funds from either your state or the Feds.

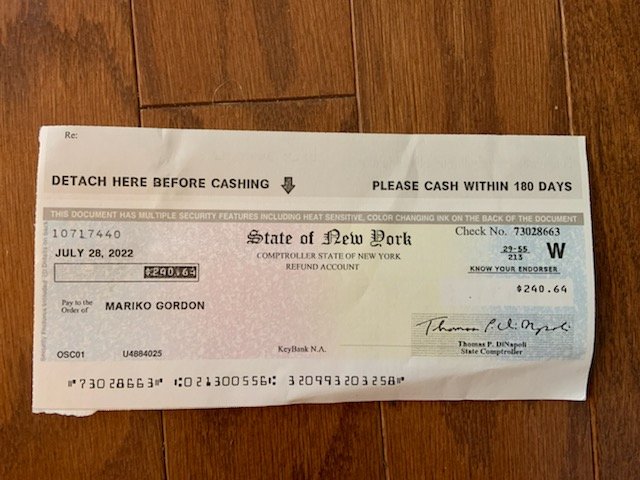

If you are owed money and businesses can’t track you down, they turn it over to the state for safekeeping. I received $240 dollars in unclaimed funds from New York State. Just google “unclaimed funds + your state” and you’ll be able to look yourself up and see if you have money desperate to be reunited with you.

Here are two other helpful resources to find your money:

The National Associaton of Unclaimed Property Administrators:

A directory of Federal databases:

Don’t be a retirement statistic.

Consolidate your “forgotten” 401Ks into an IRA and take back the stewardship of your retirement assets. Tally up all that loose change. Find any other missing money.

Paying attention and caring for your wealth is paying attention and caring for yourself.

Stay tuned next week where I’ll write more on 401K rollovers. Just remember rollovers into IRAs are always free, and easy peasy in terms of life admin. I will tackle the #1 commandment of financial savviness, which is FOLLOW THE MONEY.