Follow the Money Like a Bloodhound on Speed and Never Be a Financial Patsy Again

A few days ago I opened a personal finance newsletter and read this:

WTF?

Rolling your 401K into an IRA (Individual Retirement Account) is always free. The recipient of your IRA is thrilled to get their grubby little paws er…. hands on your money. They’re delighted to have you transfer funds from your company 401K plan into a newly opened or pre-existing IRA.

Every additional dollar they add in assets is very profitable. Custody, brokerage, and asset management are all businesses with a lot of operating leverage.

Whether you call the shots and they charge you for holding your money, or you pay them to run your money, they are not going to ever charge you to take your money.

It made no sense, and I smelled a large rat.

So I clicked on the link,

Which led me to Capitalize, a company that “makes rollovers easy.” It specializes in finding “forgotten” or “left behind 401Ks” — that is 401Ks people leave at a former employer.

As I read through the website, I got my panties in a twist.

Now, before you decide this letter doesn’t apply to you because you’re not swapping jobs, 401Ks or using Capitalize, please keep reading. This issue turns into a masterclass in how people try to separate you from your money. Stay with me. You’ll never look at a financial services website the same way again.

Here’s why I got tweaked.

For one, Capitalize makes transferring your 401K into an IRA sound like having your liver pecked out by eagles, or being left adrift on a financial raft, left to die of thirst, or worse, drowning in paperwork.

I mean, I HATE life admin, but opening an IRA and doing a transfer is easy peasy. This is not doing your taxes, settling an estate, or buying a house, FFS. Could admin screw-ups happen? Sure. Even life can fuck up cornflakes, given a chance.

BUT YOU’VE GOT THIS!

The chances of a snafu are low. This is not rocket science, turning lead into gold or getting your toddler to eat okra. You’ve faced worse, guaranteed.

But wait, there’s more!

Before I show you all the subtle ways the website manipulates you, I need to teach you to “follow the money.”

What I mean by “follow the money”:

If you are involved in a transaction where you do not know who is paying whom, how much, and for what, then YOU are the prey.

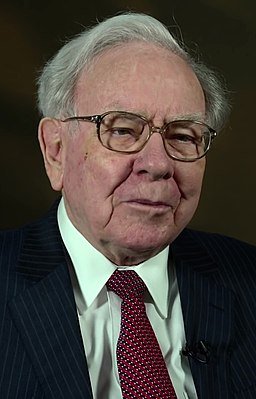

To quote Warren Buffet “As they say in poker, ‘If you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy.’ ”

By helping to rehouse trillions of “orphaned” dollars, Capitalize saves employers millions in fees. If they become THE clearing house for millions of 401K rollovers, they’ll make money six ways from Sunday.

“As they say in poker, ‘If you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy.’ ”

— Warren Buffett

I don’t begrudge them that.

But under all that “we’re doing you a giant favor” enthusiasm lurks some sophisticated and subtle practices to manipulate you into making financial decisions that may not be 100% in your best interests.

Yes, the service they offer is free, though by the time you give them the information they need, you’ll have done more admin heavy lifting than advertised.

What you want is a magic wand and poof! Your 401K balance is converted into an IRA and invested to generate lifetime Warren Buffet-like returns without you picking up a pen or making investment decisions.

What you’re getting instead:

Capitalize steers your assets into their partners’ clutches.

If you squint, you’ll read that they’ll help you transfer your 401K anywhere you want, but if you ditched your retirement account when you changed jobs, you’re probably not the squinting type. So you’re most likely going to be choosing from a shortlist.

They’re bounty hunters, in short.

Good for them for revealing they get paid a commission by their partners. But they won’t tell you how much. How can you trust their advice isn’t tainted by the size of their commission? And is your caseworker getting a bonus if you choose Firm A instead of Firm B?

If there’s a price on your head, why don’t you know what it is?

What bothers me is they use a five-star rating system for their partners, and they don’t tell you the scoring criteria. How are you to trust their ratings?

This is not a rotten tomatoes movie rating. This affects where your MONEY goes, for FFS.

You have to dig pretty deep in the process of transferring before you get to the ratings, but what tweaks me is that smaller fintech companies get a boost because they are fully integrated with Capitalize’s systems. This makes the work of transferring your account less manual, therefore cheaper and more profitable for Capitalize.

But what’s in it for them shouldn’t affect what’s in it for you.

What matters: Fees, yes. Track record, yes. Compliance record, yes. Customer service satisfaction, yes. Ease for Capitalize? Not so much.

Capitalize also owns valuable real estate – your eyeballs.

When I see that the company served up first are always the same ones, the ones they have automation with, it gives me pause. No one reads page 10 of a google search. Dollars to donuts, the 3 firms served up first and labeled as “popular” options means they’re chosen way more often than other, well-established firms with great records and low fees.

FOLLOW THE MONEY.

You are being manipulated as you’re being monetized.

Is signing up with Capitalize convenient? Yes, if you are too busy to track down your accounts, consolidate them into an existing IRA, or open a new one.

Should you consolidate? Yes, as discussed previously. And, please, dear God, do not leave it in cash. Use a target date fund – is it bespoke? No? Is it perfect? No. Is it better than staying in cash for the next umpteen years? Good god yes.

Can you do it for free elsewhere? Yes. Everywhere.

Are you being led through a subtle maze that favors where they’ll make the most money? Yes – both in terms of a commission (I can’t help but think that SoFi needs your money more than Vanguard and will pay more for it, but that doesn’t mean it’ll do a better job) or in terms of reduced costs (a fully integrated platform).

I am seeing the deployment of the Dark Arts very subtly applied to the separation of you and your wallet, and you deserve better. Learn how to follow the scent of money like a bloodhound on speed, and you’ll never be the patsy again.