Fruits of Our Labor

Female workers in a rubber factory in Lancashire, September 1918; by George P. Lewis

I grew up with a lot of stories about work.

I hung out in garages, airports, and hotels while my parents ran their rent-a-car business and learned how to deal with irate customers, flat tires, and accidents.

I listened to stories about my 8th-grade educated grandfather, a hayseed from Tennessee, who worked his way up from Wall Street messenger boy to owning a seat on the New York Stock Exchange.

I have the brass token (“bango”) that my grandparents, indentured plantation workers, presented every payday. Eventually, they bought out their contract and raised pigs. The bango became the keychain to unlock the Quonset hut I grew up in on O‘ahu.

Bango; by Mariko Gordon

I watched my grandmother work well into her 90s, tending her anthuriums in the morning and sewing quilts from aloha shirt scraps in the afternoon. She was always busy but never in a hurry and found time to pray twice a day, take naps, watch sumo wrestling, and listen to Okinawan music.

After a lifetime of backbreaking work, she struck a nice balance.

In my family, toiling for others is our love language, our source of self-esteem, and our means of running away from feelings.

It’s been hard for me to adjust to not working flat out once I closed my business, and even now I struggle to balance my second career with enjoying the fruits of my labor.

How about you? What stories did you grow up with about work? Did it have to be hard to “count”? Did work pay off? Was it a career or “just a job”? How were unions viewed? What was considered “women’s work”?

We have a lot of complicated beliefs and mixed feelings about work because our paychecks are more than a way to pay our bills.

We conflate who we are with what we do. We let our productivity, titles, and salary determine our worth, and work can also become our refuge from unhappy home lives.

Is it any wonder that you have such mixed and loaded feelings about your work and how to value your labor?

If you’re not careful, you'll end up working for free, underpaid, investing your efforts in low-return situations, and burning out.

Oyster Shuckers from South Carolina, 1912; by Lewis Hine

What follows is a remedy to being overworked and underpaid.

To be clear, I am not blaming the victim here or excusing sadistic and horrific employers. But changing how we think of ourselves and our labor can dramatically affect our well-being.

Here’s what I mean:

When you think of yourself as a capital allocator rather than a laborer, you shift your self-concept in a way that benefits your career and money decisions.

What do I mean by being a capital allocator?

Investopedia defines capital allocation as “... distributing and investing a company's financial resources in ways that will increase its efficiency, and maximize its profits.”

A female acetylene welder at work in an aircraft factory in the Midlands, September 1918; photograph by George P. Lewis

For humans, this means looking at the expense of time and energy a task entails relative to what we get in return.

Time and energy are yours by birthright. Some may live longer and others may have more energy to deploy. Still, these are ASSETS you are born with, that you can choose to INVEST into action, which will generate a (tangible or intangible) RETURN.

Think of yourself as a tiny money printing press that’s spewing bills as you chug through life.

You’re constantly making tradeoffs with your labor that affect your wealth:

You may choose to invest for the long-term, say by studying for years in medical school before you can earn a salary.

You may choose to do unpaid labor that generates an intangible return by bearing and raising children. You could tally up how much your children have literally cost you, adding estimated price tags for sleepless nights, barf-ruined clothing, and your lost earnings, but the return you’ve gotten, assuming no devil spawn, is impossible to calculate.

You may work an hour that costs you 10 units of energy to generate $100. Or you may work 10 hours that cost you 1 unit of energy to generate $100. Are these equivalent? Depends on what you value more — the expense of time or energy.

You may waste your level 10 skillset on a level 2 opportunity. Is that a good ROI? You will never get that time back. You could have bestowed your skills on an opportunity with a better pay off.

When you think of yourself as the capital allocator of your time and energy, you think of the return you want to earn differently.

So let’s look at how you get paid:

You can get paid by time spent. There may be requirements on our labor in that time e.g. a minimum number of rooms cleaned per 8-hour shift, but the unit of measure for payment is time. There are a finite number of hours in a day. Your earnings are capped by your hourly rate times billable hours.

You can get paid by the piece. You make more if you’re more efficient or productive than the person standing next to you on the assembly line. Your pay reflects your skill and effort, but is capped by the number of widgets that can be human(e)ly produced in an hour.

You can get paid for the value-added created. If you can address a need by responding faster, knowing the answer, solving the problem, or having the right tool, you can charge more. The locksmith gets paid not for her time but for her expertise, tools, and for showing up on your doorstep at 3 a.m. What were you doing out at 3 a.m. anyway? 😏

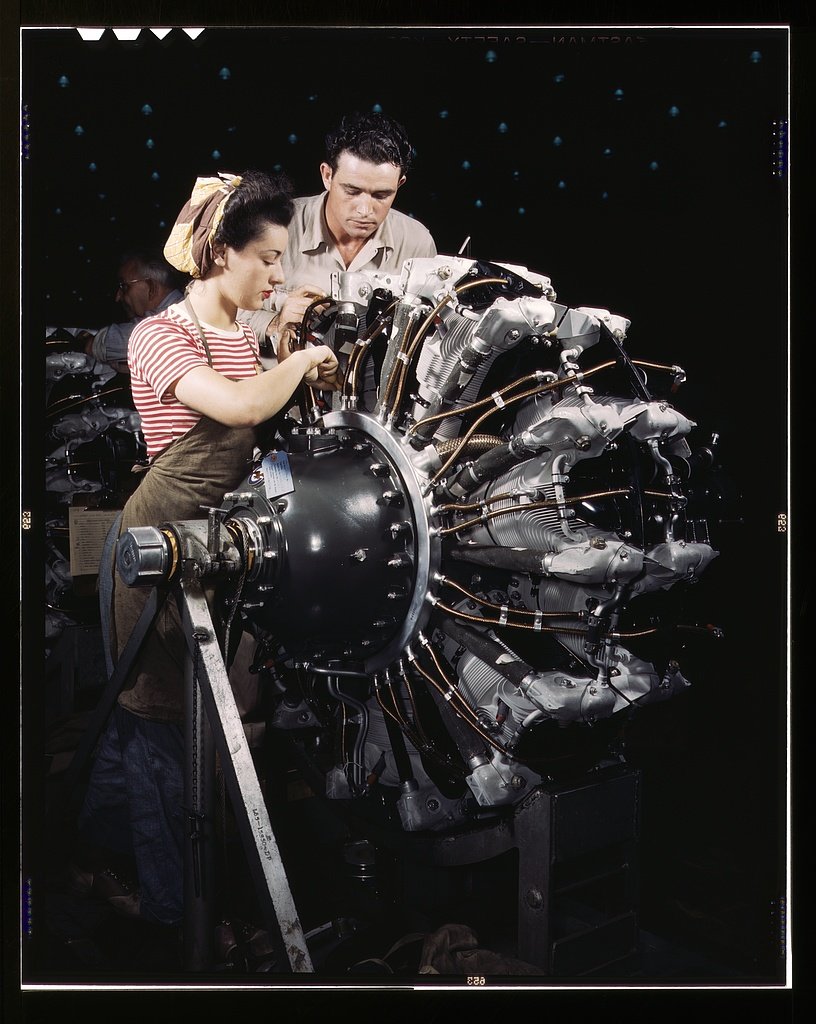

Operating a hand drill at Vultee-Nashville, woman is working on a "Vengeance" dive bomber, Tennessee 1943; by Alfred T. Palmer

You can arbitrage your way to more income. You can buy low now and sell high later. You can afford to wait until demand exceeds supply or you can buy from an ignorant seller and resell to a knowledgeable buyer.

You can leverage your labor. Welcome to the creator economy. You can make a product and generate recurring revenue forever. Slice and dice your writing, classes, or expertise into evergreen digital products.

Teach others and you’re no longer selling one do-it-for-you service at a time, but selling many people at once on a how-to-do-it class.

You can get a piece of other people’s labor à la Tupperware and Avon, or via affiliate marketing commissions, if that’s your jam.

No matter the method, the biggest upside to cultivating your riches lies in generating income, not in saving.

Of course, you want to spend less than you take in, unless you are intentionally in a negative cash flow situation in order to generate more money later (e.g., medical school). That’s a given.

But the financial advice we get tends to foster a scarcity mentality, one focused on the preservation of, rather than the creation of wealth.

You’ll hear all about not buying that latte but precious little on how to overcome systemic biases that impede wealth creation or how to think of yourself as a money printing press rather than a penny pincher.

Sure, be frugal. But enjoy life, FFS.

A group of female workers outside the glucose factory of Messrs Nicholls, Nagel and Co Ltd in Trafford Park, Lancashire, September 1918; photograph by George P. Lewis

The leverage on your wealth comes from what you can do to increase your generation of it:

Whether it’s an inner resource:

Self-care to make grounded, clear-eyed life decisions

Personal growth to break out of self-sabotage

Getting in touch with your deepest desires and motivations

Cultivating resilience & getting comfortable with uncertainty

Honing your discernment

Or an outer resource:

Learning how to ask for raises

Testing your value in the marketplace by switching jobs

Continually spotting and taking on new, more challenging opportunities while shedding lower-value tasks

(Insecure overachievers I’m looking at you! 👀 This is the hill you die on: You do well, more and more work gets piled on you, then you burn out because you can’t say no or make them take stuff off your plate.)

Learning new skills in and exploring emerging areas of industry. There are more growth opportunities in fields that are rapidly growing and where roles aren’t rigidly defined. Or seek smaller companies where you can wear many hats and acquire more skills faster.

Create passive income:

Monetize your expertise in as many ways as possible. Your expertise can be broken down and repackaged into many different forms and price points for varied audiences.

Invest and leverage the power of compounding. Build wealth over time without effort. Buy high-quality, low-cost, well-diversified, tax-efficient, dollar-cost averaged portfolios and leave them alone.

Beware the time and energy vampires that drain the value from our labor:

Unpaid labor at home. There is much unpaid labor we do out of love. Be conscious of the unpaid labor that comes from unthinking, unquestioned, kneejerk patriarchal and misogynistic systems. Housework and child care should be split equitably, and every couple gets to determine what that means for them.

Unpaid labor at work. Do not volunteer to do office housework. Everyone benefits, but no one will compensate you for it. When it’s part of your job description and you are evaluated for performing it, then go to town serving the coffee and donuts.

Opportunity gap. It’s not just the wage gap that’s an issue. It’s the compounded effect of being presented with fewer opportunities when you are a member of a marginalized group.

Opportunities allow you to create results that get you more visibility, higher pay, and even more opportunities, creating a career virtuous circle.

Those of us who were taught that our good work would always be recognized, that the nail that sticks up gets hammered down, or that it’s unladylike and immodest to toot your own horn, will get bypassed.

Throw your hat in the ring. Better yet, create the opportunity yourself.

Whew! Had a lot to get off my chest. Just remember, think of yourself as a valuable bundle of capital that you want to invest in the most rewarding opportunities available.

A price can be put on your labor, but not on you. You are priceless.

P.S.

I'll be teaching a class on Financial Intimacy for Small-Business Owners this October. You’ll make better and more profitable business decisions when you approach your financials with curiosity and listen the stories they’re telling you. Sign up here for early bird notification.